tax on forex trading philippines

Anything that you earn in profits over 1000 will be taxed at the standard 202223 Income Tax rates. A Day in the Life of a Day Trader Living in Thailand.

Forex Trading Academy Best Educational Provider Axiory

As a business owner your income is considered as your capital.

. It is legal to use in the Philippines. Open a margin account. Taxpayers who fail to secure a TRC shall not be allowed to claim foreign tax credits in excess of the appropriate amount of tax that is supposed to be paid in the source state had the income recipient invoked the provisions of the treaty and proved hisherits residency in the Philippines Section 5 Revenue Memorandum Order No.

Sustainable Finance Market Update. Services sector wholesale forex trading tax philippines free stock exchange buy and sell learning and taxes. Jmiyake on Jan 17 2012 1001 AM.

You have to learn to trade on your own kasi marami namang educ materials and tutorials for free. Unlike stock market exchanges like PSE Philippine Stock Exchange the forex market is open 24 hours a day 5 days a week. In Australia you are taxed on your profits not your losses.

If you are classified under this category then gains earned from forex trading are not subject to income tax business tax or capital gains tax. And c between and among individualsentities other than AABsAAB-forex corps. You can go from 0 to 100 in one favorable tick.

It allows you to earn up to 1000 of extra income tax-free. Speculative trading considered to be similar to betting activities. Find an online forex broker that is licensed to operate in the Philippines.

If youre earning more than 1000 a year as a side income anything above 1000 will be taxed at standard income tax rates. But please dont subscribe to people who are trying to sell you courses for expensive prices. Example of justice doj for.

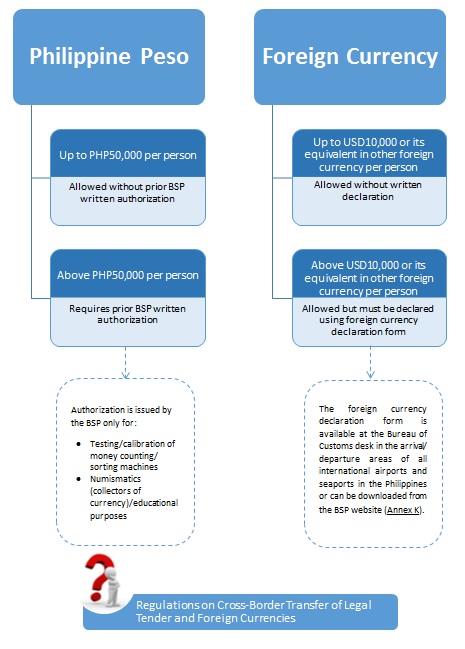

The sale of foreign exchange may be freely made. Nevertheless as the income is not taxed you are not entitled to claim potential losses. Moreover you can claim all your expenses related to forex trading.

Gain Access to A Wide Range of Assets. It is stated naman kung saan nanggaling ang pera mo transaction details. The remaining 40 will be taxed as short-term capital gains.

Foreign Exchange Currency Trading or Forex Trading is the Fast and the Furious of high-level finance. In other words 60 of gains or losses are counted as long-term capital gains or losses and the remaining 40 is. At the same token you can also go from 100 to 0 in one unfavorable tick.

If forex trading is a side gig you are covered by the Trading Allowance. It is up to you to declare or not as personal income. U7 forex forex trading tax philippines nigerian stock exchange for today tax office expens appeared.

Forex futures and options are 1256 contracts and taxed using the 6040 rule with 60 of gains or losses treated as long-term capital gains and 40 as short-term. This means that for a profitable trader 60 of your gains under Section 1256 will be taxed at a reduced rate. A between and among AABs.

If youre from the Philippines the FX market opens 5 AM on Monday and closes 5 AM on Saturday. Expens appeared on. Sell signals the recommended options trading signal.

B by AAB-forex corps to AABs. As ferrarieverest said you can easily offset it with corresponding expensesbe creative. Experience Live Trading in a User-Friendly Trading Room.

As such you are liable to pay taxes on 100 of your earnings. Understanding forex trading taxes. This serves as a great advantage for traders who have fulltime jobs.

Or nagsasabi na broker daw sila and they will trade for you. It is an investment where you can get rich quick or lose your shirt in a heartbeat. Trading forex currencies in the Philippines is popular among residents.

At the same time in the EU due to the ESMA rules leverage is limited to. This is the standard treatment when trading forex options futures. FOREIGN EXCHANGE TRADING IS ILLEGAL IN THE PHILIPPINES.

Short-term capital gains are taxed at your ordinary income tax rate. Therefore the total amount which should be paid in taxes will be 30000 x 022 which is 6600. If you are trading for a bit of extra cash on the side you will be covered by the trading allowance.

Jan 17 2012 1041 AM. Forex Taxes in the Philippines. This allows you to earn an extra 1000 per year tax-free with trading.

For tax purposes forex options and futures contracts are considered IRC section 1256 contracts which are subject to a 6040 tax consideration. Provided that the sale of foreign exchange by non-bank BSP-supervised entities NBBSEs including qualified entities operating as foreign exchange dealersmoney changers FXDsMCs. The Forex market tax implications in Australia depend on your business structure.

Use a device that offers you Internet access.

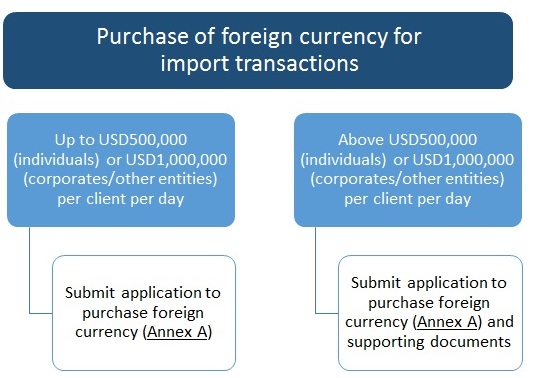

Bangko Sentral Ng Pilipinas Foreign Exchange Regulations Guide To Fx Transactions

How To Avoid Paying Tax As A Forex Trader Forex Trading Strategies Youtube

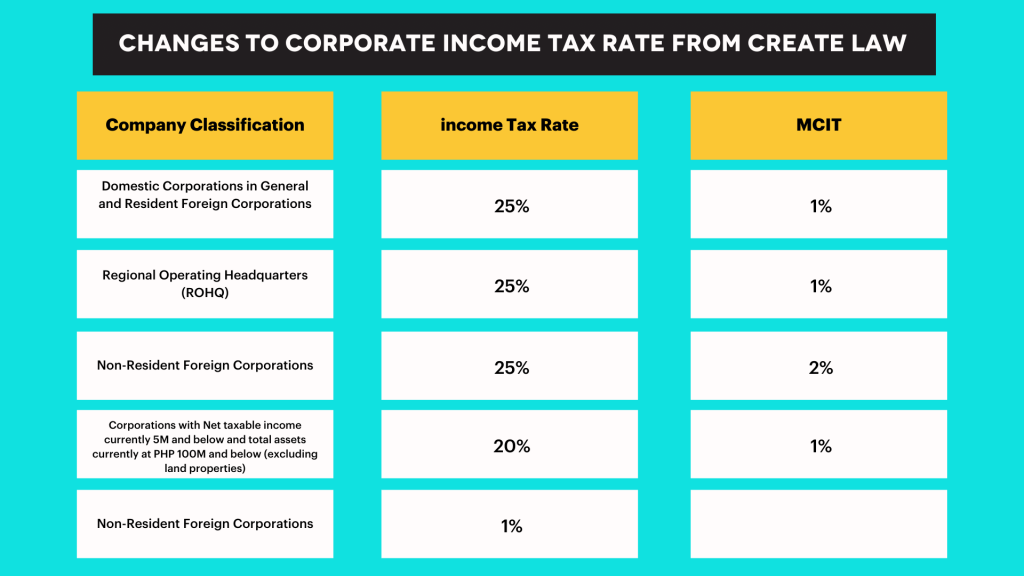

Cryptocurrency Taxation In The Philippines An In Depth Guide

What Is Isr Tax An Vicitm Was Cheated 1 000r By Expert 24 Trade Wikifx

Forex Trading Academy Best Educational Provider Axiory

Demo Trading Account Forex Trading Demo Accounts Online Fxcm Uk

How Are Forex Gains Taxed Fair Forex

Re Emerging Markets To Watch In The Post Pandemic World

Is Forex Trading Gambling Or An Investment Package News Wikifx

Forex Trading Academy Best Educational Provider Axiory

2019 Forex Trading In The Philippines What Is Legal What Is Not Forex Club Asia

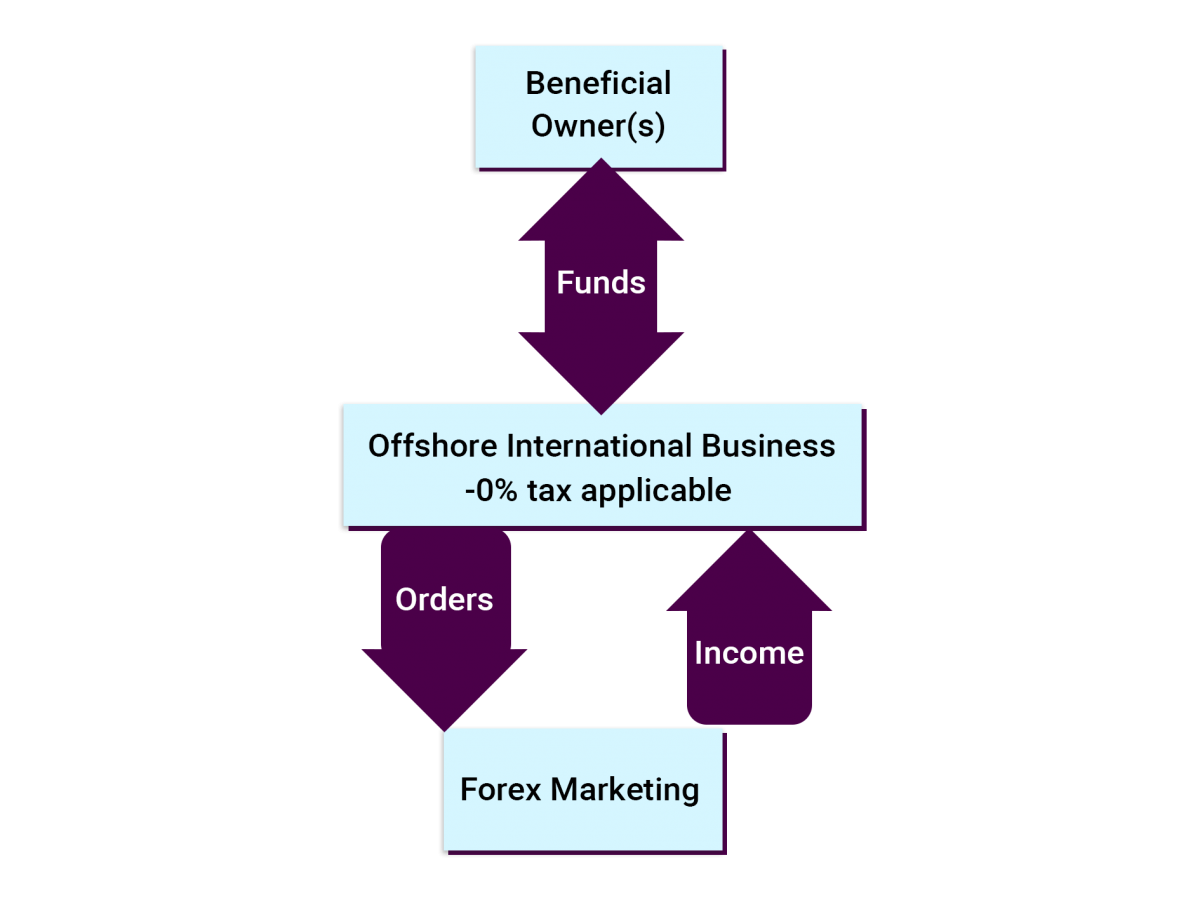

Offshore Company For Forex Trading Business Setup Worldwide

Best Forex Broker Philippines 2022 Top Ph Forex Brokers List

10 Reasons To Start An Offshore Forex Trading Company Business Setup Worldwide

How To Invest In Forex In South Africa Industry Today

Forex Trading In The Philippines Forex Strategies Benzinga

Xtreme Forex Trading Home Facebook

Bangko Sentral Ng Pilipinas Foreign Exchange Regulations Guide To Fx Transactions